Exness Minimum Deposit

Exness, a leading broker known for its user-friendly interface and wide range of trading instruments, places significant emphasis on its deposit policy, which is a key consideration for traders. Understanding minimum deposit requirements is essential for anyone looking to start trading with Exness.

Exness Deposit Rates

Exness broker is renowned for its flexible deposit rates, catering to a wide spectrum of traders. The minimum deposit amount varies depending on the type of Exness account chosen. For example, Standard Accounts usually have very low minimum deposit requirements, making them accessible to novice traders. On the other hand, Professional Accounts may require higher minimum deposits, reflecting the advanced tools and features available to more experienced traders.

The minimum deposit level is not only the gateway to start trading, but also influences other aspects such as margin calls and leverage. It is important for traders to understand that while lower deposit requirements lower the barriers to entry, they also come with higher risks, especially in highly volatile markets.

| Standard | Cent Standard | Pro | Zero | Raw Spreads | |

| Minimum Deposit | Depends on the payment system | Depends on the payment system | $200 | $200 | $200 |

| Spread | Starting from 0.2 pips | From 0.3 pips | From 0.1 pips | From 0 pips | From 0 pips |

| Commission | No commission | No commission | No commission | Starting from $0.05 each side per lot | Up to $3.50 per side per lot |

Deposit Methods and Fees at Exness Broker

Exness offers a variety of deposit methods to suit the diverse needs and preferences of its clients. This flexibility is a key aspect of the broker’s appeal, especially for traders who need multiple options to fund their accounts. Understanding the structure of deposit methods and associated fees is essential for effective financial planning and management in trading.

Exness Metode Deposit

Exness offers a variety of deposit methods to suit the varying preferences and requirements of its international clients. The broker has structured its deposit options to include both traditional and modern methods, increasing accessibility and convenience for traders. However, the availability of these methods may vary based on the trader’s location and their country’s specific regulations.

Deposit methods at Exness include:

- Bank Wire Transfer: Ideal for those who prefer conventional banking methods. While widely accessible, this option tends to have slower processing times.

- Credit/Debit Card: Supports major card types such as Visa and MasterCard. This method is preferred for its simplicity and universal acceptability.

- E-Wallets: These include popular digital payment platforms such as Skrill, known for its fast transactions and ease of use, Neteller, known for its secure online payment capabilities, and WebMoney, valued for its comprehensive security features.

- Cryptocurrencies: Bitcoin and similar options offer fast and secure transactions, but be aware of potential value fluctuations affecting deposits.

The range of deposit methods provided by Exness ensures that traders have the flexibility and convenience to choose the option that best suits their trading needs and geographical constraints.

| Payment method | Deposit Amount | Speed |

| Perfect Money | 10 – 100.000 USD | Up to 30 minutes |

| Skrill | 10 – 100.000 USD | Up to 30 minutes |

| Bank Online | 15 – 1000 USD | Up to 1 hour |

| Bank Card | 10 – 10.000 USD | Up to 30 minutes |

| Bitcoin (BTC) | 50 – 10.000.000 USD | Up to 1 day |

| Neteller | 10 – 50.000 USD | Up to 30 minutes |

Exness Commissions and Deposit Fees

One of the main benefits of using Exness is its user-friendly approach to commissions and deposit fees. The broker seeks to minimize the costs associated with funding a trading account, which is clearly visible in its fee structure:

- No Commission for Most Methods: For most deposit methods, Exness does not charge any commission or fees. This policy increases the affordability of trading activities.

- Possible Third Party Fees: Although Exness itself does not charge deposit fees, traders should be aware of the potential fees from the payment service provider they choose. These fees vary depending on the provider and transaction specifications.

Processing Time for Exness Deposits

Exness stands out in the market with efficient processing times for deposits, an important factor for traders in a dynamic market environment:

- Instant Deposits with E-Wallets and Cards: For methods such as credit/debit cards and e-wallets, Exness usually offers instant deposit times. This feature allows traders to fund their accounts and start trading with minimal delay.

- Bank Transfer: This traditional method may take a few business days to process. The exact time frame depends on the banks involved and their specific processing schedules.

Exness Account Currency Options

Exness offers the flexibility of multiple account currency options. Traders can open accounts in major currencies such as USD, EUR, and GBP, as well as several other local currencies. This variation is advantageous because it allows traders to deposit funds in their local currency, thereby potentially saving on conversion costs and reducing the hassle associated with currency conversions.

| Account | Currency |

| Standard Cent | USC EUC GBC CHC AUC CAC |

| Standard, Pro, Zero, Raw Spread | AED ARS AUD AZN BDT BHD BND BRL CAD CHF CNY EGP EUR GBP GHS HKD HUF IDR INR JOD JPY KES KRW KWD KZT MAD MXN MYR NGN NZD OMR PHP PKR QAR SAR SGD THB UAH UGX USD UZS VND XOF ZAR |

Step-by-Step Guide: How to Deposit Money in Exness

Depositing money into an Exness account is an easy process. Here’s a simple guide to help you through each step:

- Start by logging into your Exness Personal Area. This is your hub for managing funds and accounts.

- After logging in, open it and click on the ‘Deposits’ section in your Personal Area.

- Select your desired deposit method from the list of available options.

- Enter the deposit amount you wish to deposit, making sure it meets the minimum deposit requirements for your account type.

- Follow the instructions provided on the screen to complete your deposit. This may involve authenticating with your e-wallet or entering your credit card details.

- Once your deposit is successful, you will receive confirmation. The deposited funds will then be available in your trading account, ready for trading activity.

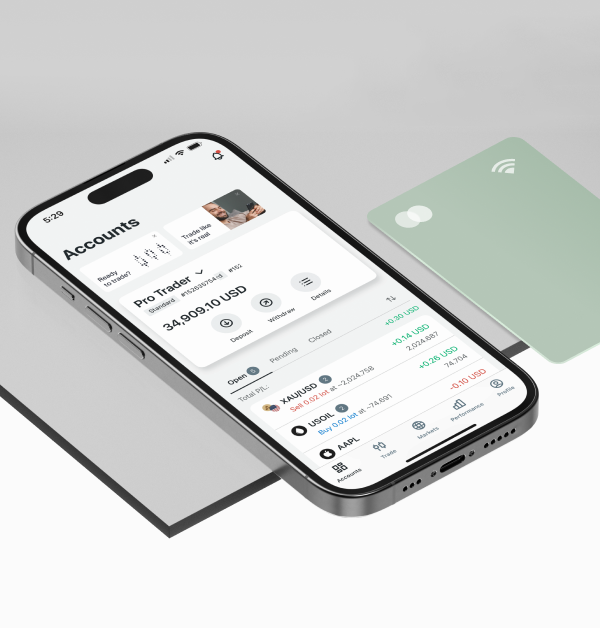

Making a deposit into your Exness trading is very easy, whether you prefer trading on Exness MetaTrader 4, Exness MetaTrader 5, Exness Web Terminal, or even anywhere using the Exness App. Each platform offers an intuitive interface to manage your funds effectively, enabling a seamless transition from deposits to trading on your chosen markets.

Security of your deposit funds with Exness

Fund security is a top priority for traders, and Exness is very committed to safeguarding its clients’ deposits. This broker has implemented several strong measures to ensure the highest level of fund security:

- Separation of Funds: Exness implements strict separation of client funds from company funds. This ensures that client money is exclusively used for trading purposes and not for any other company activities.

- Regulatory Compliance: Exness operates under the supervision of several financial authorities, adhering to strict operational standards. This regulatory framework includes specific guidelines on how client funds should be handled, further enhancing security.

- Secure Transactions: The security of the transaction process at Exness is the most important thing. All transactions are protected with advanced encryption, significantly reducing the risk of unauthorized access or fraudulent activity.

- Risk Management Tools: Exness equips traders with a variety of tools and resources to manage their risks effectively. This layer of indirect protection is critical to maintaining the integrity of deposited funds.

Importantly, the process of securing your funds with Exness starts from the early stages of engagement. Starting with Exness registration, which is efficient and secure, traders can feel confident in the integrity of the system. The Exness account verification process further strengthens this security, ensuring that all account details are thoroughly checked and verified. For those still exploring the platform, an Exness demo account provides an excellent opportunity to understand these security measures in a risk-free environment.

In short, Exness’ commitment to the security of client funds spans the entire spectrum of its operations, from registration and account verification to trade execution and risk management. These comprehensive steps ensure that traders can focus on their trading strategies with peace of mind, knowing that their funds are in safe hands.

Exness Minimum Deposit: Frequently Asked Questions

Why am I being charged a fee when Exness claims free deposits?

Although Exness does not charge fees for deposits, fees may arise from your payment service provider such as a bank or e-wallet service. These fees are charged by the provider, not Exness. It's best to confirm any potential fees in advance with your payment provider to avoid surprises.

Can I trust the safety of my funds at Exness?

Yes, you can count on the safety of your funds with Exness. The broker takes various security measures, including separating client funds from their own funds, complying with financial authority regulations, and using encrypted transactions. Exness also offers risk management tools to further protect clients' investments, contributing to reliability and confidence in the security of funds.

Are there any fees associated with depositing at Exness?

Exness does not charge fees for deposits or withdrawals. However, please note that some Electronic Payment Systems (EPS) used for transactions may have their own fees. It is recommended to check the specifics of this payment system at Exness to avoid unexpected fees.

Can I deposit into a trading account with a negative balance at Exness?

Yes, you can deposit into an account with a negative balance. However, wait for the automatic null operation that resets the negative balance to zero before making a deposit. This operation does not deactivate your account, but cannot be done manually.

What should I do if negative balance funds are deducted from my deposit?

If you deposit to a trading account with a negative balance and a negative amount is deducted from your deposit, especially when there are no open trades, you should contact Exness Support for assistance in recovering the deducted amount. To avoid such deductions and resume trading immediately, consider opening a new trading account and depositing your funds there, ensuring that your deposit is not affected by the negative balance of the previous account.

Is it possible to start a deposit outside Exness working hours?

Yes, you can make deposits outside of Exness working hours, as deposits, withdrawals and transfers are available on weekends and holidays. However, keep in mind that these days are not considered "business days", so any transactions that require verification may experience delays. You are also advised to know the forex market trading hours so you can plan your strategy and manage your funds effectively, especially during these hours.