Exness Deposits And Withdrawals

With over 600,000 active users, Exness is one of the largest online CFD and forex brokers offering a wide range of financial instruments and competitive conditions. This popular forex broker is regulated by seven trusted authorities such as the UK’s FCA and Cyprus’ CySEC while being a market leader with a wide range of tradable products. That includes cryptocurrencies, forex pairs, stocks, energies, metals, and more.

Apart from offering favorable trading conditions and a wide range of trading products, Exness offers friendly deposits and withdrawals. However, beginners need to understand the deposit and withdrawal processes available for online trading in order to manage their accounts effectively.

This online trading guide will provide you with important information about the deposit and withdrawal methods available when trading with Exness. We will also cover the general time frames traders can expect when depositing and withdrawing funds, as well as tips for speeding up your withdrawals from Exness MT4 and Exness MT5.

Available Funding Methods and Base Currencies

Exness gives you a variety of payment options, each with minimum deposit limits and processing times. Here is a complete list of funding methods available to Exness traders:

- Transfer Bank

- Webmoney

- Wire Transfers

- Credit/Debit Card

- Perfect Money

- Skills

- Neteller

Please note that each country may support different payment methods, so check the options available in your jurisdiction before making a deposit. You can find a complete list of available payment methods in your Personal Area. You’ll also see the reason why a method is blocked in your region.

Exness Base Currency

Exness has different base currencies depending on the type of trading account you choose. For a standard account, you can use different currencies, including:

ARS, AED, AZN, AUD, BND, BHD, CHF, CAD, CNY, EUR, EGP, GHS, GBP, HUF, HKD, INR, IDR, JPY, JOD, KRW, KES, KWD, KZT, MXN, MAD, MYR, NZD, NGN, OMR, PKR, PHP, SAR, QAR, RHB, SGD, UAH, USD, UGX, UZS, XOF, VND, ZAR.

Remember that you cannot change the base currency after creating a trading account. Therefore, any deposits you make using different currencies will be subject to conversion fees. Therefore, it is very important to choose the right base currency to avoid unnecessary fees. However, you can open multiple Exness trading accounts for different base currencies in the same private area.

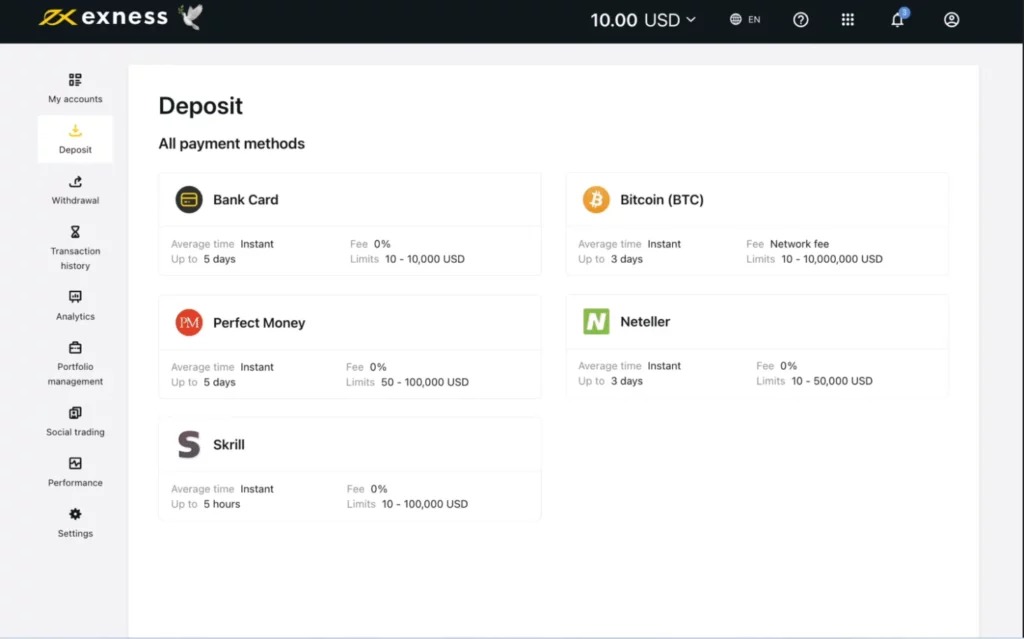

Overview Deposit Exness

When depositing cash into your Exness trading account, you will have several banking options, including the following.

- Credit/Debit Card

Exness accepts Mastercard, Visa, and credit cards from major banks worldwide. To deposit using your debit or credit card, simply enter your bank card details and the amount to deposit. This option is quick and easy to use, but you may incur transaction fees from your bank.

- Electronic wallet

Exness also accepts various digital wallets such as Skrill, Neteller, and Perfect Money. You can easily link this digital wallet to your Exness trading account and deposits are instant. However, not all traders may be comfortable with third party involvement.

- Direct Bank Transfer

Exness allows online traders to fund their accounts from their bank accounts via wire transfers and other direct bank transfer techniques. To fund your trading account using this method, you will need to obtain your Exness account details and initiate a transfer from your bank’s online portal or visit your branch. Funds will usually appear in your trading account within 72 hours, but there are no fees charged and deposit limits are high.

- Cryptocurrency

Crypto enthusiasts can fund their Exness trading accounts using digital currencies such as Bitcoin, Tether, Ethereum and others. You just need to transfer digital coins from your wallet to your Exness address and the funds will appear in your account once your transaction is confirmed. Fortunately, there are deposit fees for cryptocurrencies, although these assets can be very volatile.

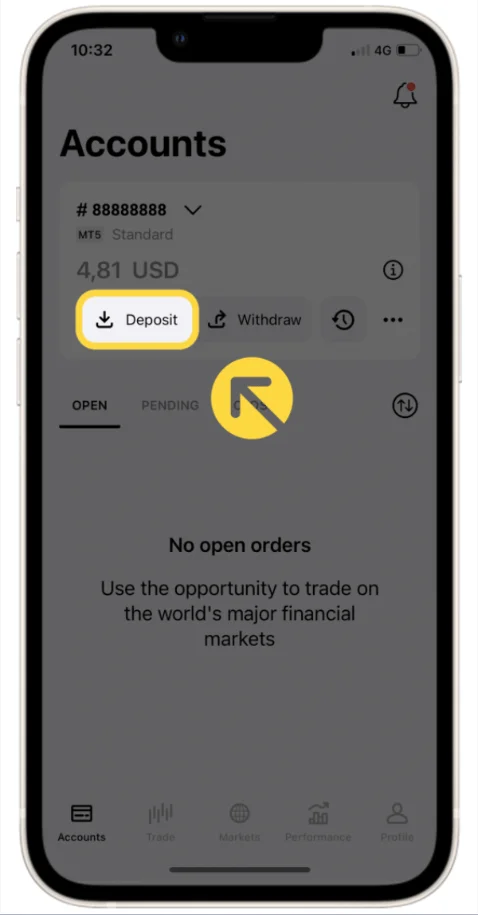

How to Make a Deposit at Exness

Although Exness has a wide variety of deposit methods to fund your account, the process is easy and intuitive using these simple steps:

- Open the official Exness website or application and enter the personal area of your account. New traders at Exness must create an account first.

- Once you have entered your personal area, click on the “Deposit” option in the side menu.

- Choose your desired payment method, from credit cards and bank transfers to e-wallets and cryptocurrencies.

- Enter your account number at Exness, the base currency you chose, and the amount to deposit. Once finished, click “Next”.

- Double check your deposit details and confirm your payment.

- Your app or web browser will automatically redirect to your payment provider and you can follow the instructions provided on the screen to accept the payment request. Once complete, your payment provider will process your payment and the funds will be credited to your account.

Exness Deposit Limits and Fees

Deposits at Exness must meet specified limits and you may be charged fees depending on the payment method you choose. However, different Exness trading account types have set limits, so it is very important to check the description of your account profile and the help section. For example, a standard trading account has a minimum deposit limit of $1, while a professional account has a limit of $200.

In addition to the account type, the payment method you choose will also determine the minimum Exness deposit you can make:

- Yandex Money – 1 USD

- Kartu Credit/Debit – 3 USD

- Perfect Money – 2 USD

- Skrill – 10 USD

- Neteller – 10 USD

- Transfer Internal – 1 USD

Exness usually does not charge any fees to fund your trading account, but the payment provider you choose may charge some fees. Deposit processing time also depends on the payment system you choose. However, most direct deposit systems transfer your funds within seconds after confirmation of the transfer being completed.

Benefits of Depositing Funds with Exness

Exness believes that all deposits to your trading account should be easy, fast and safe. Apart from providing various payment options, Exness also provides other benefits to traders including:

- Exness traders can deposit their funds at any time, including during holidays and weekends.

- All deposits at Exness are free, although some banks, credit card providers and third-party payment systems may charge additional transaction fees.

- Deposits are secure as Exness does not allow third parties to make payments on behalf of their users.

- Some deposit methods are instant, meaning you can fund your account and start trading within minutes.

- Standard online trading accounts at Exness have friendly minimum deposit requirements, although the amount may vary with the payment method you choose.

- Exness is a legal broker, ensuring all transactions comply with regulatory standards and guidelines, giving traders peace of mind regarding the security and legality of their deposits.

Exness Deposit Bonus

Although Exness offers an impressive range of financial instruments, it does not provide any deposit bonuses and that is not in line with their core ideological values. Instead, Exness allows their customers to earn a stable income through their partnership program. You can join the broker’s program and earn up to 40% of their revenue from every trader you introduce to Exness or earn up to $1850 for each client through their affiliate program.

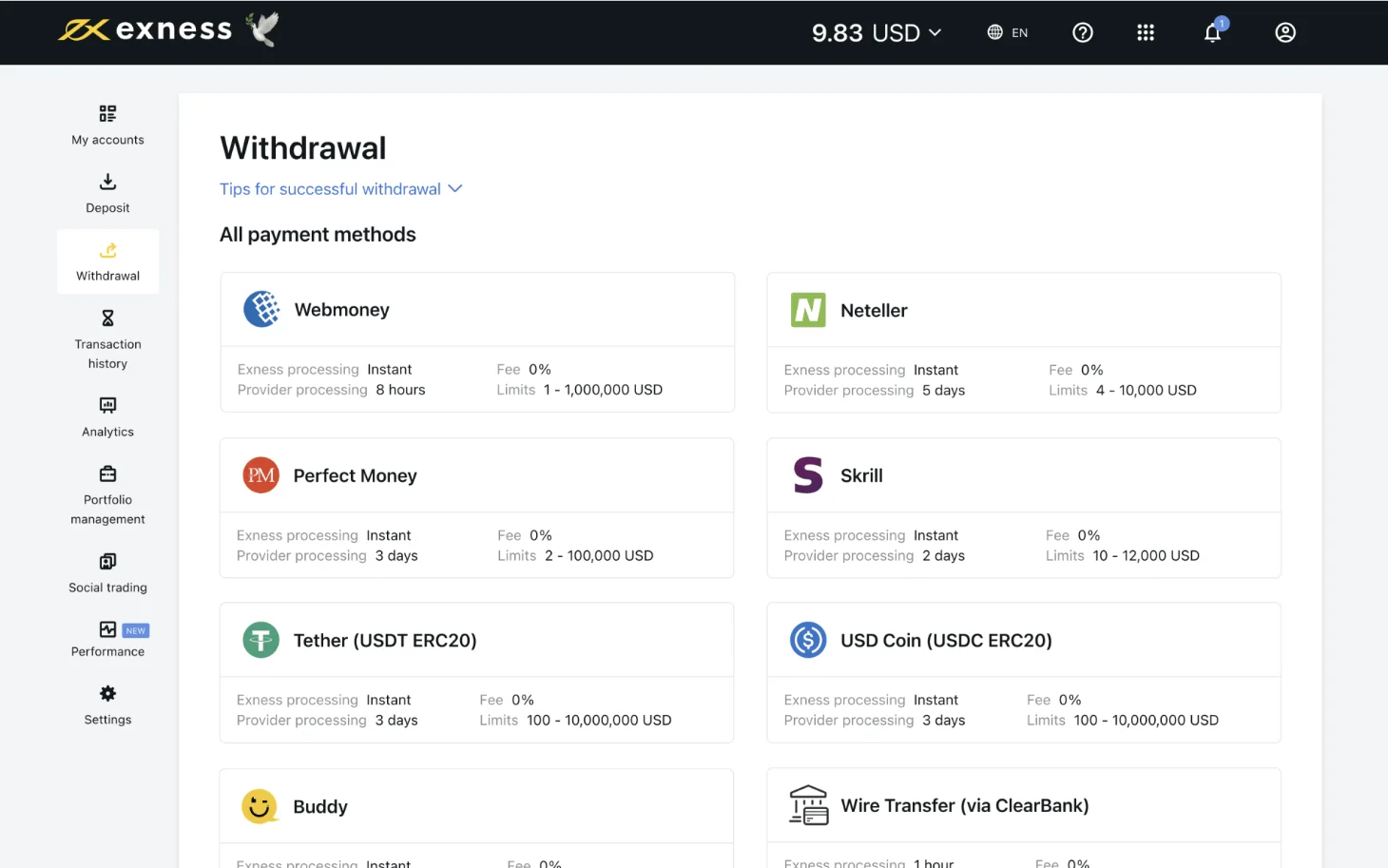

Exness Withdrawal Guide

Withdrawals are an important factor for online trading because they allow you to access your funds. When trading with Exness, withdrawal options are similar to deposits and they include:

- Bank Cards: Exness traders can make withdrawals via Visa, Mastercard and other credit cards. Withdrawals are processed within one business day, but there are withdrawal limits and bank fees.

- Bank Transfer: You can ask Exness to transfer your funds directly by providing our bank details to initiate the transfer. These withdrawals arrive within 1-3 business days for most banks, but no fees are charged.

- E-wallets: Linking e-wallets such as Skrill and Neteller allows you to withdraw funds from Exness and receive your funds within minutes. However, there is a possibility of third-party transaction fees in some cases.

- Cryptocurrency: Crypto enthusiasts can withdraw funds from Exness to their digital wallets. This transaction is fast, secure, and there are no fees charged.

How to Withdraw Funds from Exness

You can withdraw your funds from Exness using various payment methods with the following simple steps:

- Visit the official Exness website and enter the Personal Area of your Exness account.

- Select the “Withdrawal” option from the side menu located on the left of the page.

- Select your preferred payment method.

- Enter your account details at Exness, your currency and the amount to withdraw, then click “Next”.

- Double check your withdrawal details and enter the code you will receive via SMS before confirming payment.

- Provide credentials for your target payment account such as account name and bank name to complete your transaction.

Exness Withdrawal Time

Withdrawal processing times vary depending on the method you choose:

- Bank transfer: 1-7 days.

- E-wallets and bank cards: Instant – 24 hours.

- Cryptocurrency: up to 24 hours.

Exness Withdrawal Limits and Fees

To ensure fairness and transparency, Exness has several policies regarding withdrawal limits and fees. Here are some important points to remember:

- Exness does not charge any withdrawal fees, but some third-party payment processors may have their own fees.

- The minimum withdrawal limit for most payment methods is $1, except for direct bank transfers, which allow a minimum withdrawal of $50.

- Exness reserves the right to reject withdrawal requests that do not comply with their policies.

Exness Withdrawal Problems

Although Exness strives to make the withdrawal process smooth, there are some cases where withdrawal requests may experience delays or rejection. Below are common withdrawal problems that Exness traders may face.

Incorrect Funds Withdrawal Details

Entering incorrect or incomplete information on your withdrawal request may cause processing delays and errors. This is a common problem that many online traders face at Exness, especially when operating multiple accounts or using different banking methods. Therefore, it is very important to double-check your payment details, including name, account number and specific banking method before you submit a withdrawal request.

Incomplete Account Verification

Unverified trading accounts at Exness may experience withdrawal restrictions due to the company’s strict KYC and anti-money laundering policies. This policy is implemented to ensure the security and safety of trader funds. Therefore, it is important to complete the Exness verification process by uploading proof of address and valid identification documents to avoid delays and frustration when withdrawing funds.

Unsuitable Payment Methods

Generally, Exness requires that withdrawals be processed using the same banking method you selected for deposit. Attempting to withdraw your funds via a different payment method may result in rejection. For example, if you deposit funds via debit/credit card, you must use the same account to withdraw your funds. Traders who wish to change their payment method must update the details in their account settings before requesting a withdrawal.

Technical problem

Although rare, technical problems can also cause problems with withdrawing your funds at Exness. These technical issues can include server downtime, system maintenance, and other unforeseen circumstances. If that happens, it is best to contact the Exness customer support team for assistance with your withdrawal request.

Trade Anywhere with the Exness Mobile App

For smooth operations, Exness does an excellent job of ensuring their online traders have access to a reliable mobile trading application. This advanced mobile trading application provides a desktop-like experience that meets the needs of all traders. Thus, traders can access the features and tools available on the desktop version via their smartphones.

Some of the main features of this app include:

- It gives online traders access to a variety of indicators to assess trading charts and implement different strategies.

- The Exness app helps traders follow economic trends, read price pattern evaluations, and access important market news.

- Manage trading accounts including demo accounts.

- Access to in-app calculators for accurate swap, spread and margin calculations.

In addition to these features, the Exness app allows you to deposit instantly, access more than 130 financial instruments, and withdraw your funds on demand. Additionally, the Exness app offers a seamless customer support team to ensure that you can invest with confidence that your funds will be safe from anywhere.

Security Measures for Safe Transactions

Investing in financial instruments carries an element of risk, but Exness has a variety of security measures to safeguard your trading experience. These security measures include:

Strong Account Security Features

Exness takes a two-step approach to securing your account. Their strong data encryption protocols stand as the first line of defense, ensuring that traders’ personal information is safe. That means the data you share with Exness is safe from prying eyes.

In addition to a solid encryption protocol, Exness goes the extra mile to provide a two-factor authentication system for its traders. In addition to using your password to enter your private area, the Exness app sends a unique code to your phone to verify your identity every time you want to access your account.

Separate Client Accounts

To safeguard traders’ funds, Exness provides a separate client account to keep your funds separate from the company’s funds. This minimizes the risk of misuse or misappropriation of funds, adding a level of transparency and protection when handling trader funds.

Compliance with KYC Requirements

To verify the identity of their traders, Exness strictly adheres to KYC requirements. When opening an account, you are required to provide certain documents that verify your location and identity. It helps prevent money laundering, fraud and other illegal activities, maintains the integrity of the platform and protects traders’ interests.

Tips for a Smooth Transaction Process

To ensure a smooth and user-friendly experience when depositing and withdrawing your funds on Exness, here are some practical tips to keep in mind:

- Immediately verify your account by providing relevant identification documents to avoid deposit or withdrawal restrictions.

- Use the same payment method for all your deposits and withdrawals to avoid potential problems receiving your funds.

- Monitor your account balance to ensure you have sufficient funds in your account before requesting a withdrawal.

- Double-check banking details when depositing and withdrawing funds to ensure there are no processing delays or errors.

- Contact the customer support team for assistance if you experience technical problems with deposits or withdrawals.

Customer Support and Assistance

To find in-depth information or seek help with Exness deposits and withdrawals, contact their professional support team and find the answers you need. The customer support team is available 24/7 and you can communicate with them via live chat, email, or phone. However, the support team will ask you to provide your support PIN and account number if you already have an account.

Conclusion

Exness strives to offer you a seamless deposit and withdrawal experience, making it the leading platform for online financial traders worldwide. By following the steps and tips we have discussed in this guide, you can use your Exness account effectively to achieve your trading goals. Remember to research the different payment methods available and don’t hesitate to contact the Exness support team if you have any questions.

Questions and Answers about Exness Payments

How do I deposit money into my Exness account?

To deposit money into your Exness account, log in to your account, navigate to the 'Deposit' section, and select your preferred deposit method. Options often include bank transfers, credit/debit cards, and e-wallets. Follow the on-screen instructions to complete the transaction. Deposit times may vary depending on the method chosen.

What is the process for withdrawing funds from an Exness account?

To withdraw funds, log in to your Exness account and go to the 'Withdraw' section. Select your preferred withdrawal method, enter the amount you want to withdraw, and follow the instructions to complete the transaction. Withdrawal times and fees depend on the method used.

How to use PayPal for transactions on Exness?

If PayPal is available as a transaction method in your region, you can select it for deposits or withdrawals in your Exness account. Simply select PayPal in the deposit or withdrawal section, enter the amount, and you will be redirected to PayPal to complete the transaction. Please note that availability and transaction limits may vary.

Can I use internet banking to withdraw funds from Exness, and how does it work?

Internet banking can often be used for withdrawals. Select internet banking in the withdrawal section of your account, enter the withdrawal amount, and provide the required banking details. Transactions may take several days to process, depending on your bank and region.

What features does Exness and Mastercard debit offer users?

Exness Debit and Mastercard usually offer features such as direct access to funds in your trading account, ease of use for online and offline transactions, and lower withdrawal fees. These cards may also offer higher transaction limits and faster processing times compared to other withdrawal methods. Features may vary, so it's best to check specifically what's offered in your area.